NamPay EFT Debits and Credits

Payment Initiation

Payment initiation refers to the customer providing their bank with an instruction to complete either a credit transfer or a debit collection to another customer, either within their own bank or to another bank. Payments can be initiated in multiple methods such as internet banking systems, business banking systems or even through third party payment service providers, to name a few.

Customers using NamPay will be migrated from the current EFT system over the course of an 18-month migration period. As part of the implementation, the local banks will communicate directly with their customers on how the interaction with the payments system will change and how this will impact them. The extent of the impact on the customer will be specific to the types of products, channels and relationships customers have with their respective banks.

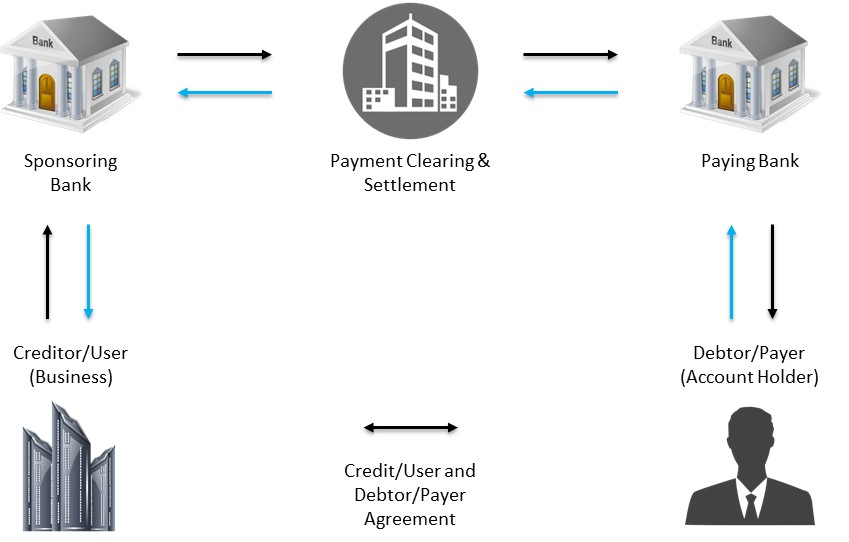

Payment Clearing and Settlement

Payments clearing and settlement refers to transactions processed between customers of different financial institutions or banks. The process requires a clearing house (Namclear in Namibia) to facilitate the transfer of funds and ensure that the nett amounts transferred are settled between the financial institutions.

NamPay will enhance the existing process for EFT transactions where the traditional model of clearances of transactions over multiple days will be replaced with current day processing. This means that transactions sent on any given business day will clear and be settled, regardless of whether the transaction is sent to a beneficiary in another bank, on the current business day. The system will further improve and automate the process for settlement between banks resulting in lowered financial risk to the National Payments System as a whole.

NamPay will also introduce a near-real-time EFT payment stream that will enable customers in different banks to make immediate payments that will clear and reflect within 1 minute. The new payment streams (EnDO, ENCR and NRTC) are explained in more detail below.

Enhanced Debit Orders (EnDO)

The current debit order system will be replaced by an enhanced collection process, called EnDO, that will benefit both the submitter of debit orders (Creditor) as well as the consumer paying that debit order (Payer).

Key features of the EnDO stream include the following:

- Debit orders are submitted using the new industry payment standard ISO20022.

- Institutions that submit debit orders or on behalf of other institutions or entities are required to register as a collector.

- Users are able to send debit orders that will have the ability to repeatedly check for funds (credit tracking) on the debtor’s account over a period of time which will improve the success rate of collections.

- Debit Orders will be processed three times daily after the morning salary credit run.

- All debit orders are fully randomised to avoid preferential treatment on collection of funds.

- Debit orders will not be “unpaid” but rather “unsuccessful” on the consumer’s account resulting in fewer disputes and queries, however the existing debit.

- The customer’s credit record will be impacted should the debit order be unsuccessful

- Should a debit order request on a debtor/payer’s account not be honoured, it will automatically be returned to the originator.

Enhanced Credit Transfers (EnCR) and Near-Real-Time Credit Transfers (NRTC)

The current EFT credit payments system will be replaced by two new streams (ENCR & NRTC) that will enhance the way that money can be transferred across all banks in the National Payments System. This involves the ability to continue to transact within a current day and the capability to transfer money immediately to any beneficiary in Namibia, whether they bank at the same institution or not.

Key features of the EnCR & NRTC streams include the following:

- Payments can continue to be made to any bank beneficiary but will now be processed on the new industry standard ISO20022

- Transactions are processed by means of “trickle-feeding” between the banks as received in the business day between 08h00 and 16h00 and are therefore not subject to overnight or multiple day clearances unless submitted following the close of the business day

- The audit trail of the processed payment is maintained such that a payment customer can easily track their transactions at any stage

- An electronic process is in place to handle transactions processed erroneously

- Data enriched messages allow for better anti-money laundering controls to prevent fraudulent activity

- The NRTC payment stream enable any consumer to transfer in real-time to any beneficiary within the business day